Masterworks Review: A Way To Invest In Fine Art

You may not know this, but I create original artworks with the interior paint I use for each house I’ve bought since 2003. Not only is art fun, but maybe one day, these original pieces will sell for megabucks! So when Masterworks approached me to do a sponsored post about investing in fine art, I welcomed them with open arms.

Masterworks, founded in 2017, is an investment platform that helps non-accredited investors buy shares of fine art. The fine art market has been booming due a surge in wealth by the investor class. Further, with the growth of countries like China, there is more capital chasing fine art than ever before.

Fine Art vs. The S&P 500

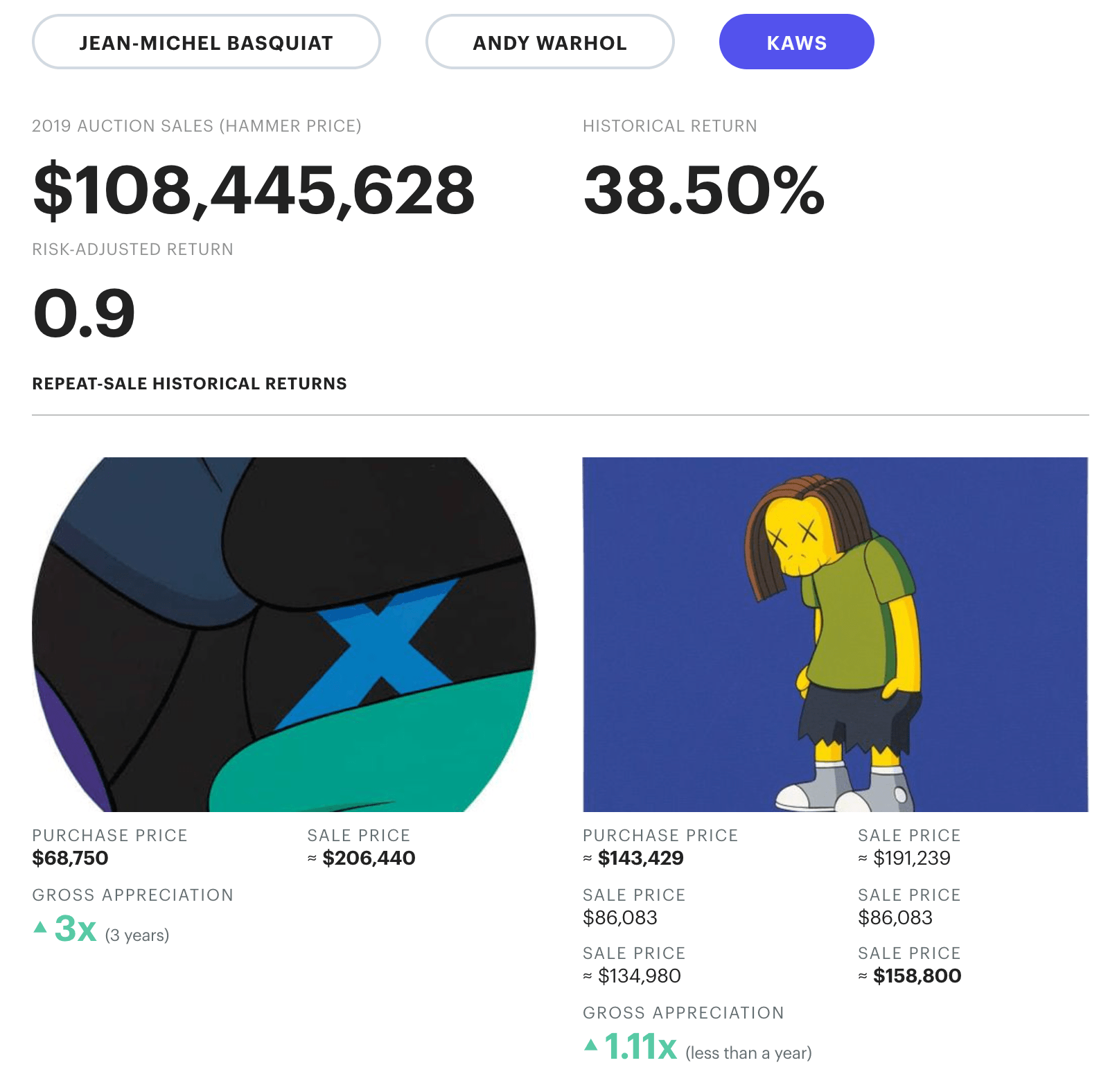

Check out the price performance chart of the Artprice100© Index versus the S&P 500 since 2000. Included in the index are artists such as Robert Rauschenberg, Ed Ruscha, Cimabue, Kaws, Picasso, Modigliani, Claude Monet, Paul Cézanne, Andy Warhol and Jeff Koons.

It’s clear that fine art has performed very well in comparison to the S&P 500. However, investors on Masterworks are buying a share of a particular artist’s work, not a fine art index fund. Hence, your investment choice matters more for performance.

Over the years, Masterworks performance has been strong. With a bear market returning in stocks in 2022, interest in investing in fine art has increased due to its non-correlated characteristics. During times of uncertainty, you want to own real assets like real estate and fine art that has as little correlation with stocks as possible.

How Does Masterworks Work?

Masterworks purchases works of art from a list of artists determined by their proprietary algorithm. Masterworks target appreciation for each artwork is between 9% to 15%.

Once it purchases the art, Masterworks registers the art with the SEC and issues shares in $20 increments. Investors on the Masterworks platform can then own a portion of an artwork with no minimum investment. Masterworks limits the total investor share to no more than 10%.

The target holding period is between 3 to 7 years. When it comes time to sell the artwork, the new buyer with his or her new price must be approved by a majority shareholder vote.

Interview With Masterworks Founder, Scott Lynn

Sam: Tell me a little about your career and what motivated you to start Masterworks?

I’ve been starting technology companies for the past 20 years, but also collecting art around the same period of time. Art has been one of my best performing investments, but I realized the only way for someone to participate in the asset class is if they have millions of dollars to acquire it.

Surprisingly, we were the first company to come up with the idea of securitizing a painting, which has now led to a new asset class for investors.

Sam: What is Masterworks’ value proposition? Why is Masterworks better than competing platforms?

We currently don’t have any competition. Our focus is on investment-grade artwork that generally begins at $1 million per painting, ranging up to $10 million per painting.

We also have the leading research team in the art market. Like any asset class, you only want to invest with partners who have experience in the market — our team has more than 100 years of combined experience in the art market. We also have secondary markets where investors are trading shares in paintings.

Sam: What is the definition of blue-chip art? And how does art go from obscurity to blue-chip? It seems so subjective.

Our research team has coined the term “blue-chip” to help typical investors draw analogies with other asset classes. We specifically define “blue-chip” as art created by the top 100 artists (in terms of sales volume), which constitutes more than 60% of the art market. These are household brand names such as Picasso, Monet, Basquiat, and more.

Sam: What do you think about art sold on cruise ships? Is it investment-grade?

While we encourage people to buy art that they love for decorative purposes, we don’t consider this investment grade. In order for it to be an investment, you need to have sufficient data to conclude that the artwork you’re investing in is appreciating.

Roughly half of the $64 billion in sales volume that occurs each year is through public auction, so there is a large data set to analyze to understand appreciation rates for potential investors.

We publish returns on more than 80,000 paintings that have been bought and sold within the Price Database section of the Masterworks.io website.

Sam: Can you clarify the most valuable type of art in terms of levels of supply? Did most blue-chip artists do prints with numbers and signatures? How would you quantify the value of an original versus a print etc?

Almost all important artists have done some type of print work in their career, whether it’s an etching (Rembrant) or a lithograph (Picasso, for example, did both).

There isn’t a way to “discount” the value of a print based on a painting. However, clearly the most valuable art is from artists who are most in demand (and often most well-known) with the least supply.

We see this when analyzing $100 million+ paintings that sell every year — there are only a handful of artists who have achieved this milestone, such as Andy Warhol, Pablo Picasso, Jackson Pollock, and Willem de Kooning.

Sam: What type of price premium does an artist and his/her work usually get after dying?

The fact that an artist dies is not, in itself, significant. But what happens when an artist dies is that the supply (e.g., the total body of work the artist has created) begins to decline as collectors donate paintings they own to museums.

As paintings are donated, and there is less work for collectors to purchase, it becomes more “rare” and causes prices for what is left to increase. This is a unique attribute to art as an asset class — it is one of the few asset classes with continuously declining supply.

Sam: Here is a piece of art I created where there is only one in existence. There are no prints, etching, lithographs, nada. As a result, I believe this piece is worth at least $1 million today. What do you think?

I’ve owned Jackson Pollock’s work personally throughout the years, so I’m very familiar with his drip paintings. Although yours is a great example , the fact of the matter is that it’s not “culturally significant” because it wasn’t painted in the late 1940’s.

The reason Jackson changed painting in America is not because of his technique, but because he was one of the first painters in American history to paint in a non-figurative way.

For example, he painted abstractly, rather than painting people or still lives. Today this seems novel, but was revolutionary in 1940’s America.

Sam: How does Masterworks decide which art to invest in with the capital raised?

Our research team uses our proprietary database to decide which artists are accelerating most quickly. The research team then continuously updates our “artist list,” (which is around 45 artists today) for our acquisitions team.

Our acquisitions team is constantly in-market and tracking more than 1,500 paintings by these artists. We only buy the best examples and the best value — or less than 1% of everything we’re offered.

Sam: How is a Masterworks investment taxed? Is there a K-1 or W2?

All proceeds are taxed on a K-1 for U.S. investors, to provide optimal tax efficiency. For international investors, we use a Cayman subsidiary so that all proceeds are taxed in their local jurisdiction.

Sam: Do you have a Masterworks fund that invests in multiple pieces of art for more diversification and liquidity purposes?

We don’t offer a fund right now. Although it’s something we’re considering for the future, it isn’t a near-term priority.

Sam: What are some new initiatives Masterworks is looking to launch in the next three years?

In addition to fund-like products, we want to continue to build-out features on our Secondary Market to support investors trading shares with each other. In other words, if an investor does not want to hold onto his investment for 3-7 years, he can sell his shares on our Secondary Market.

Sam: How does a Masterworks investor know s/he is investing in a particular artwork? Where is the art piece stored? Is it insured for theft, damage, etc?

In terms of governance, we have the highest standard of any investment product. Each painting is a public offering, qualified by the Securities and Exchange Commission.

Investors can go to www.sec.gov, search for Masterworks, and read all of the details underlying each investment product. Due to SEC review, these products have much higher standards than private investment offerings.

All paintings are stored in the Masterworks Gallery (in Soho, NYC). If not, they are on loan to museums. Finally, they are fully insured in the event of theft or damage.

CNBC Interview With Masterworks

For a video explanation of Masterworks, here’s an interview I did on CNBC that shares more about Masterworks.

Masterworks Conclusion

If you’re interested in investing in fine art, sign up for Masterworks and explore our offerings for free. Fine art is an alternative investment and another way to diversify your investment portfolio.

There is currently a ~25,000 person waitlist to invest in Masterworks, but you can skip the waitlist and sign up with this link. Our goal is to continue introducing more fine art supply every month.

See Masterworks’ disclaimer: Masterworks.io/disclaimer

***

I want to thank Scott and Masterworks for their insights into the fine arts market. Although I’m somewhat bummed my original artwork isn’t “culturally significant” and worth $1 million each, perhaps if I continue to create over the next couple of decades, they will be.

When it comes to any type of art or entrepreneurial endeavor, you never know the upside until you try!

Readers, any artists out there? How about any fine art investors? It’s always nice to invest in something that also provides joy and value. After a robust 2020, investors are looking to alternative asset classes to provide returns. When you can invest in an asset class that you can also enjoy, that’s a nice combination.

Review Summary

Reviewed by

Financial Samurai

Review Date

Reviewed

Masterworks

My Current Rating

Product Name

Masterworks

Price

USD 1000

Product Availability

Available in Stock

No Comment! Be the first one.