Yieldstreet Review: Pros, Cons, And Alternatives

Yieldstreet is an investment platform that offers high-yield alternative investment opportunities to individual investors.

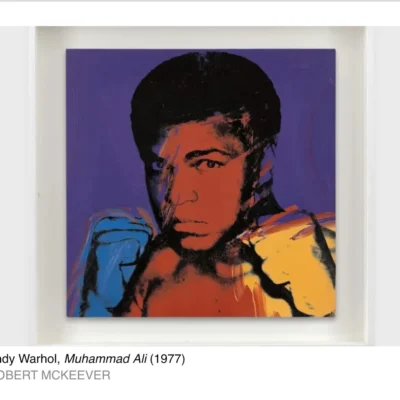

These investments include everything from real estate, commercial and consumer financing, litigation financing, art, and more.

It’s the huge diversity of offerings that make YieldStreet unique compared to other alternative investment platforms (such as ones that just focus on real estate or art).

Is it the right place for you to buy alternatives or should you look elsewhere? We dig into the pros and cons, and look at the numbers surrounding YieldStreet and it’s offerings.

Editors Note – May 25, 2024: Yieldstreet has been impacted by the financial troubles of a couple of its financial technology and banking partnerships, namely Synapse, which provided services to Yieldstreet. While the company has yet published any updates on its website regarding the status of its accounts, online customer reports are showing that Yieldstreet has paused withdrawals.

What Is YieldStreet?

YieldStreet is an alternative investment platform that connects individual investors with private equity deals. To invest through YieldStreet, you must be an accredited investor. This means you have earned more than $200,000 per year over the last two years ($300,000 for couples) or have $1 million in net worth.

In most cases, YieldStreet invests in real estate deals such as hotels, industrial complexes, or student housing. But unlike many of the real estate funding sites, YieldStreet doesn’t limit itself to the physical real estate class. Investors can opt into fine art, ships or tankers, real estate debt, lawsuits settlements and other investment alternatives.

Show Me The Numbers

When it comes to investments, the most important thing to look at are the numbers. These are YieldStreet’s most important numbers.

- Average Fees: 2% per year on average, with a few other small fees. These are industry average fees for private equity, but are much higher than the fees you would see on ETFs or Mutual funds.

- Minimum Investment: $2,500 per offering

- Expected Returns: The projected yields range from 8%-20% but the actual performance may vary.

- Length of Investment (Lock-Up Period): Ranges from 6 months to 5 years

- Size of Platform: $1 Billion Invested

- Minimum Income To Invest: You must be an accredited investor to invest in YieldStreet’s deals. That means you must have earned $200,000 individual income or $300,000 joint income (with a spouse) in the last two years. Alternatively, you can have $1 million net worth outside of your primary residence.

What Is Interesting About YieldStreet

In my opinion, it can be hard for any investor to untangle the marketing hype on a platform from the actual value of the investments offered. And to a certain extent, I think YieldStreet leans heavily on the hype of alternative investments. That said, YieldStreet does appear to offer two compelling value propositions.

Potential Returns: The most obvious value proposition is the potential for great returns. YieldStreet targets returns ranging from 8% to 20%, and it rejects over 90% of deals presented to the platform. While no company can guarantee performance, it seems like YieldStreet’s offering could yield very solid returns.

Low Correlation: The other thing that I found interesting about YieldStreet was the lack of correlation with the stock market. High correlation means that an investment moves up and down in price at the same time a stock market index (say the S&P 500) moves up and down. YieldStreet offers low correlation investments. That means the ups and downs of YieldStreet have not (to this point) correlated with the ups and downs of the stock market.

Yieldstreet Prism Fund: For non-accredited investors, you can invest in a fund that invests in the alternative assets.

Including low correlation investments in your portfolio can be a smart move. It smooths out the returns in your portfolio, and tends to lead to higher returns overall. Including “alternatives” (anything outside of stocks and bonds) in your portfolio can lead to higher overall returns. With esoteric offerings, YieldStreet truly qualifies as an alternative.

Drawbacks Of YieldStreet

While YieldStreet has compelling features, it’s not a silver bullet. There are several drawbacks to investing in YieldStreet that I think could be easily overlooked.

One of the biggest is that they are under investigation by multiple government agencies. See this report from the Wall Street Journal.

These are four things that I don’t like about YieldStreet.

Limited Offerings: Right now, YieldStreet has one real estate offering and a “fund” which is a private, non-traded REIT (real estate investment trust). If you really want to diversify your portfolio, you’ll need to constantly watch the site for compelling deals. Having real diversity in your alternatives allocation could take years.

No Secondary Market: YieldStreet investments aren’t liquid. In general, your money will be locked up for three or more years before your capital and interest are returned. For many investors, that will be okay, but if you’re seeking liquidity, YieldStreet isn’t a good option.

Limited Track Record: While most of the deals I saw on YieldStreet’s site had yields close to YieldStreet’s projections, that could be coincidental. It is very difficult to dig into YieldStreet’s historical performance. And even if you could, each deal is quite different from other/current deals on the site.

Investors Are Expected To Be Experts: Investors on YieldStreet have to choose whether to invest in certain offerings. The offerings are unique, and YieldStreet provides lots of information on the deals. However, most investors aren’t experts in litigation settlement investments or fine art investments. But investors on YieldStreet are treated like experts. Personally, if I’m going to dig into the weeds of an investment, I want some control over the outcome. For example, I personally prefer owning a physical rental property as opposed to owning shares of a private REIT. This could be personal preference, but it is worth noting.

Final Thoughts

In general, we’re concerned about what YieldStreet is doing. Democratizing alternatives investing (even among accredited investors) is valuable for investors and for the market, but there doesn’t seem to be enough information about Yieldstreet’s investments and success to make a good judgement.

That said, the lack of control, the limited offerings, and the esoteric nature of YieldStreet’s investments makes me nervous. For the right accredited investor, YieldStreet’s offerings could make sense for a portion of their portfolio. I would advise any investor to limit their exposure to any single deal and to slowly invest into a variety of offerings on the site, if you risk it.

No Comment! Be the first one.