a Deep Dive Into Alternative Investments

Paid non-client promotion: Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate investing products to write unbiased product reviews.

Yieldstreet is an online crowdfunding platform for accredited and non-accredited investors to invest in a range of alternative investment products, such as real estate, structured notes, and art. The user-friendly platform has strong historical returns and multiple account options, including retirement savings accounts.

- Access to alternative investments, including art, real estate, and legal settlements, that allow investors with plenty of assets to further diversify their portfolios

- Investors receive regular interest payouts over the life of the loan

- Higher-risk investments — best for those with a large amount of money to invest; limited investments available

- Fees may be higher than other types of investment accounts

- Investments are highly illiquid

Insider’s Take

Yieldstreet is best for experienced, high-income/high-net-worth investors, but folks who don’t have six figures to invest in should look elsewhere. Yieldstreet is one of the best real estate investing apps for folks interested in real estate and alternative investments.

Product Details

- Consider it if: You’re a high-net-worth investor interested in diversifying your investments across real estate and other alternative assets.

- Awards: Listed on CB Insights’ Fintech 250 ranking as a Top Fintech Startup

Introduction to Yieldstreet

Yieldstreet is one of the best real estate investing apps, offering a diversified private market portfolio of vetted investment opportunities. You’ll receive curated portfolio recommendations from third-party managers who take a holistic approach to wealth-building and risk management.

Accredited traders (those with a high net worth) can easily generate passive income with Yieldstreet’s entire collection of alternative asset classes, like venture capital, private credit, and structured notes. However, non-accredited investors are limited to the Yieldstreet Alternative Income Fund.

Yieldstreet best suits accredited investors seeking further portfolio diversification and wealth-building opportunities. It’s not ideal for beginners or risk-averse traders, as investing in real estate and similar investment products carries significant risk and these investments are generally illiquid.

Yieldstreet: Overall Rating

How Yieldstreet Works

Yieldstreet has a range of asset types and classes with varying minimum investment requirements, terms, and IRA eligibility. The available asset classes include real estate, art, multi-asset class funds, private equity, transportation, crypto, venture capital, private credit, legal settlements, and short-term notes.

When reviewing fund options, Yieldstreet is transparent about what’s involved with each investment, the underlying strategy, the total offering size, risks, and expected return. However, Yieldstreet’s fund options are only available for a set period, and it’s first come, first served, so there’s a chance you can miss investment opportunities if you’re too slow.

You can invest in three asset types that derive different returns:

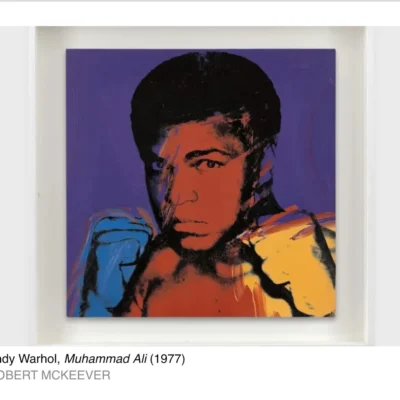

- Equity: This high-return, high-risk asset type primarily generates returns from either price appreciation or the underlying assets’ capital gains. For example, the Art Equity Fund V invests in unique artworks from mid-career and (re)emerging artists in the hope that the works will appreciate in value over time. It has a $15,000 minimum investment requirement and a monthly closing cadence over a five-year term.

- Credit: For lower returns and risk, this asset type is primarily focused on short-term investments for increased liquidity. It derives returns from income generated from a contractual stream of cashflows. For example, the Short Term Note Series CXXVIII provides monthly interest payments over a nine-month term for a $10,000 minimum investment.

- Other: Returns from investments that derive from both contractual income and price appreciation/capital gains. For example, the ST Income Notes Diversified Portfolio XLVI is a diversified portfolio of three different income notes that each reference different underlying stocks with varying characteristics to help mitigate the risk of investing in each underlying asset. It has a $15,000 minimum investment requirement and a nine-month term.

Keep in mind that you’ll be subject to a lock-up period before getting your capital back from Yieldstreet, which can significantly limit your liquidity. A lock-up period is a window of time during which investors cannot sell or redeem shares of a specific investment. Depending on the investment, this can range from three months to five years.

Most funds show a positive return, but Yieldstreet is clear that not every investment works out. So, you must understand the risks involved when deciding if it makes sense for your investment goals.

You may also access the Yieldstreet Wallet, a savings account held at Evolve Bank & Trust. This FDIC-insured high-yield savings account is typically used to fund investments through Yieldstreet, including IRAs.

Yieldstreet Alternative Income Fund

The Yieldstreet Alternative Income Fund (formerly the Yieldstreet Prism Fund) is the only investment option available for both non-accredited and accredited investors. This diverse private market fund is designed to generate income through quarterly distributions with an 8.1% annualized yield. There’s a $10,000 minimum.

The fund combines 20+ income-generating alternative asset classes — including private credit, real estate, and money market funds — for broad market exposure and capital appreciation.

While the Alternative Income Fund works like a mutual fund in many ways, there are some important differences. Your investment is not highly liquid. That means you can’t just sell your shares if you need the cash for something else. If you invest in this fund, it’s important to understand that your funds are tied up for several years outside of planned quarterly distributions.

IRA Accounts

Yieldstreet partnered with IRA custodian Equity Trust so investors can add private market investments to self-directed IRAs for higher returns and decreased market volatility. More than 85% of Yieldstreet’s alternative investment products, including select real estate funds, private credit, structured notes, and private equity, are IRA eligible.

You can open a self-directed IRA (traditional, Roth, SEP, or SIMPLE) directly through Equity Trust or Yieldstreet. Equity Trust’s concierge team can also handle retirement plan transfers and rollovers. Yieldstreet is also offering a reduced account fee (as little as 0.09% annually) for members.

Yieldstreet Fees

Yieldstreet requires a $10,000 minimum to start investing. It also charges between 1% and 4% in annual management fees, depending on what you’re invested in.

Alternative Income Fund has an annual expense ratio of 3.74%, a 1% annual management fee, an estimated annual leverage expense fee of 1.22%, a subsidiary 1.02% tax expense, and an adjusted annual expense ratio of 1.50%.

Equity Trust self-directed IRA requires a $500 minimum investment.

Pros and Cons of Yieldstreet

Yieldstreet Trustworthiness

Yieldstreet has a D rating with the Better Business Bureau. The bureau says it assigned this rating because multiple unresolved complaints were filed against the business.

However, the BBB also says on its website that ratings don’t guarantee whether Yieldstreet will be reliable or perform well.

In 2022, the SEC filed charges against Yieldstreet for allegedly failing to disclose important information to investors, resulting in a significant loss of funds. Yieldstreet neither admitted nor denied these allegations but settled the lawsuit on September 12, 2023, paying a penalty of over $1.9 million in fees.

Yieldstreet vs. Other Alternative Investment Platforms

Yieldstreet vs. Fundrise

Yieldstreet is a great option for investing in fine art, real estate, and multi-asset class funds. Fundrise, however, best suits individuals who are solely focused on real estate investments (e.g., REITs and real estate funds) and Fundrise IPOs.

Accredited investors interested in building wealth and diversifying their investment portfolios across various alternative investable securities, should consider Yieldstreet. Although Yieldstreet technically accepts non-accredited investors, they’ll be limited to Yieldstreet’s Alternative Income Fund.

Therefore, non-accredited investors and real-estate-focused investors are better off with Fundrise. Fundrise also has a lower minimum investment ($10) and generally lower fees.

Yieldstreet vs. CrowdStreet

Yieldstreet and CrowdStreet both offer a wide range of alternative investments. CrowdStreet is best for wealthy and experienced real estate investors interested in investing in single-sponsor funds, individual deals, and managed portfolios. But you’ll need more to get started at CrowdStreet. While Yieldstreet has a $10,000 minimum, CrowdStreet requires at least $25,000 (up to $250,000 for some offerings) for newcomers.

CrowdStreet only accepts accredited investors. Although Yieldstreet mainly caters to accredited investors, non-accredited investors can still invest in the Alternative Income Fund for broad market exposure and quarterly distributions.

Yieldstreet FAQs

Yieldstreet is a safe real estate and alternative investment platform with data encryption software, two-factor authentication, and an FDIC-insured wallet. However, its investment options pose high risks with the potential for large losses. While most Yieldstreet funds are successful, there’s no guarantee.

Fees on Yieldstreet vary depending on the funds you choose to invest in, but minimum investment generally ranges from $10,000 to $25,000, with annual management fees from 1% to 4%. Yieldstreet is transparent about its fee structure, so you can review each fund before investing.

You can invest in Yieldstreet if you’re not an accredited investor. Although Yieldstreet primarily caters to accredited investors, non-accredited investors can invest in Yieldstreet’s Alternative Income Fund for a $10,000 minimum and 8.1% annualized yield.

Why You Should Trust Us: How We Reviewed Yieldstreet

We examined Yieldstreet real-estate investing app using Business Insider’s rating methodology for investing platforms to compare and examine account types, pricing, investment options, and overall customer experience when reviewing investing platforms. Platforms are given a rating between 0 and 5.

Real estate investing platforms offer multiple assets, trading tools, fees, and other resources. Some investing platforms are better for more advanced investors or active investors, while others may better suit beginner and passive investors. Yieldstreet was evaluated with a focus on how it performed in each category.

SoFi Checking and Savings

Earn up to 4.60% APY on savings balances and up to a $300 bonus with qualifying direct deposit. FDIC Insured.

No Comment! Be the first one.